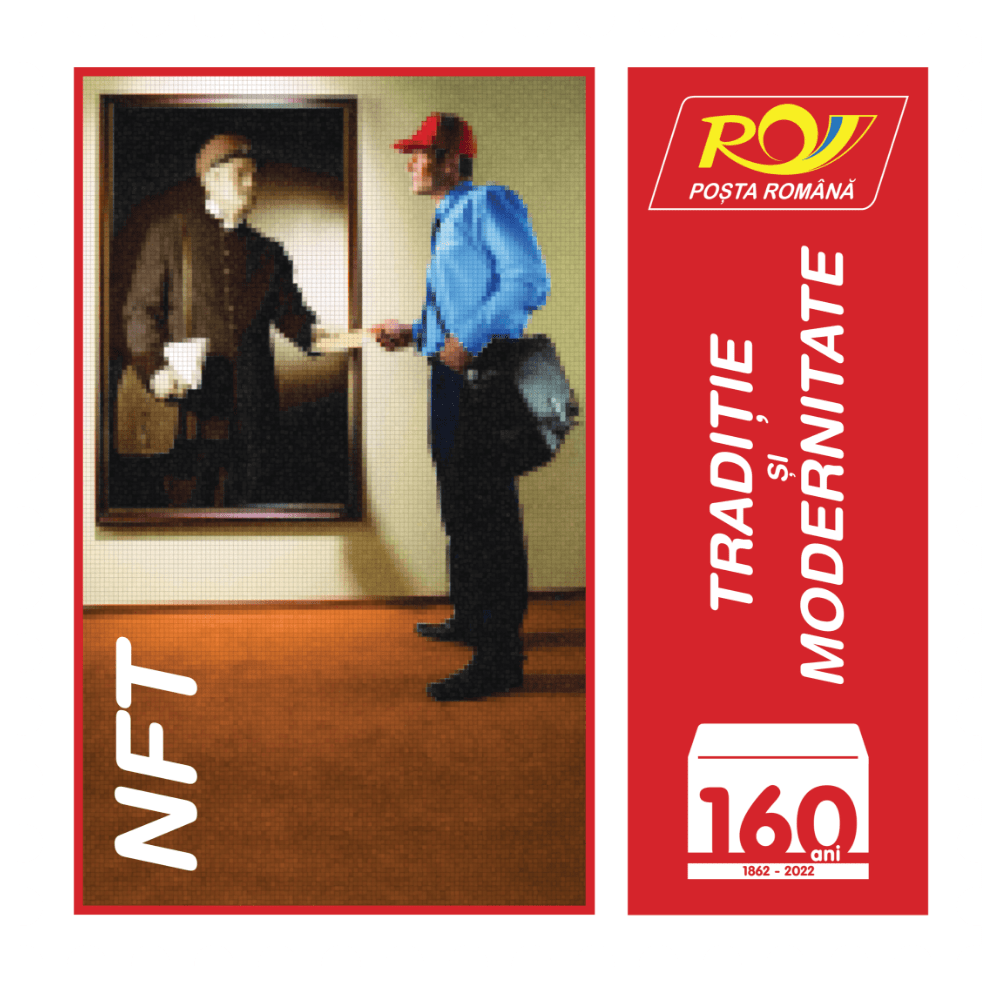

To mark its 160th Anniversary, the Romanian Post launched an NFT collection of 160 digital stamps available for purchase. And Oveit was there as the technology partner, ensuring that anybody interested could easily purchase the NFTs.

The entire event is built around the number 160. 160 years since the Romania Post was established through a Royal Decree, 160 digital stamps were minted as NFTs, each representing a year in the Institution’s history, 160 Euros is the price of one NFT. However, this number has another significance as well. 160 Euros is the cost for a hospitalization day at HOSPICE Casa Sperantei, the humanitarian organization helping those suffering from incurable diseases.

All earnings resulting from the sale of the NFT collection are going to HOSPICE Casa Sperantei, the collection having an entirely charitable purpose.

We were honored and extremely happy to be part of this project. We’ve always treasured innovation and made our best to create software solutions that help others. That has an impact on the communities that our partners are serving. And this project checked all the boxes.

Distributing the NFTs

The 160 NFTs have been divided into two categories: 10 of them, representing years of significant importance in Romania’s History, have been selected for an open auction. Of course, the starting price for the auction was 160 Euros. The rest have been sold online, for a fixed amount, here.

Using Oveit to sell NFTs

Oveit was initiated as an event ticketing software, developing more complex solutions like cashless payments software, digital wallet, or NFT ticketing. This helped us understand that one of the most important parts of developing powerful software solutions was to make them easy to use.

The National Post needed a technology partner to make the NFT acquisition as flawless as possible.

Payment. When trying to reach broader audiences you need to take into consideration several potential concerns. And payment can be one of those concerns. To make the collection available to a larger audience, we’ve activated payment with both crypto and fiat currencies. Yes, with Oveit customers can easily pay with fiat currencies for NFT tickets (or NFTs serving any purpose for that matter).

Buying an NFT with Oveit

As mentioned, we focused on creating a solution that allows customers to buy NFTs as easily as possible. The whole experience can be embedded into any website, allowing you to customize the buying process.

Just like ordering an e-ticket, customers can select the desired amount and proceed to the next steps. Being built on top of a registration system, Oveit allows you to collect relevant information from your customers, helping you better understand their wants and needs. Once these steps are completed, the customers are redirected to the payment page – but not before allowing them to select how they want to pay for their NFTs; through fiat (through Stripe or PayPal) or cryptocurrencies (through Crypto.com).

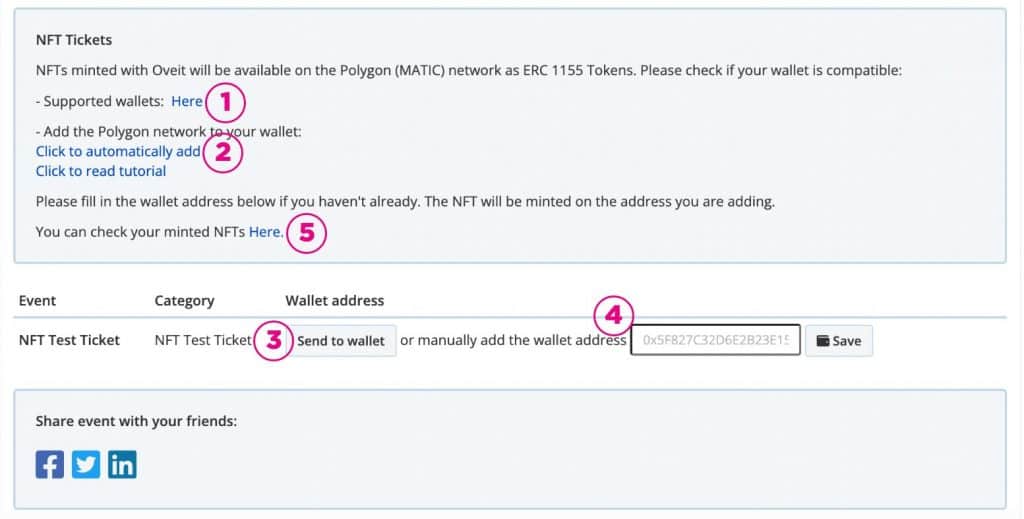

Once the payment is confirmed, customers are redirected to a confirmation page where they can connect their wallets. As Polygon is our technology of choice, we provide two options here:

- if the customer has a MetaMask wallet, the system will automatically connect the NFT to their wallet

- if the customer uses a different wallet, all they have to do is enter their wallet address in the designated field.

When the wallet is connected, the minting process starts. The minting is done by Oveit, with the help of our partners, and it doesn’t require any extra steps from you or your customers.

Having the NFT is minted, Oveit sends an email to the buyer. The email will offer more information on the collectible and has direct links to Rarible and OpenSea, allowing the buyer to check the artwork. A step-by-step tutorial on how to claim an NFT issued with Oveit is available here.

What’s next for Oveit NFT ticketing?

We are happy to see more and more event organizers, artists, and businesses using our NFT ticketing feature. Technology has the power to transform the entertainment industry. We feel that all ticketing will become NFT ticketing.

Oveit’s NFT ticketing tool helps you:

- easily create and safely sell NFT tickets

- get access to secondary market sales through royalties

- set up smart contracts that allow revenue to be fairly distributed amongst all parties

- sell merchandise together with the NFT tickets

- connect virtual and in-person experiences by using collectible tokens

- Join the Web3 revolution and create the next big thing in experiences

…and so much more.

However, our experience showed us that there is a huge untapped market, as the process of buying an NFT may be considered difficult by some. This is why we are now working on a solution that will allow anyone to buy and use an NFT; even those that don’t own a digital wallet.