To manage your tax information and export relevant details from Oveit, follow these steps:

Navigating to the Invoices Section

- Access the Backend:

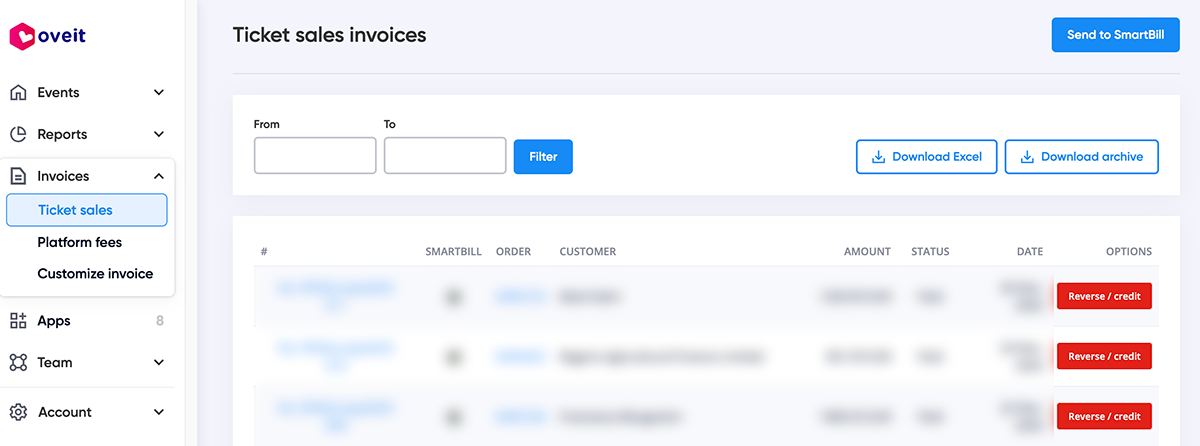

- Log in to your Oveit account and navigate to the Invoices section.

- Open the Ticket Sales Subsection:

- Within the Invoices section, go to Ticket Sales to view transaction details.

Filtering Data by Date

- Select Date Period:

- Use the From and To calendar inputs at the top of the page to specify the date range for the records you want to analyze.

- This helps you narrow down your data to a specific timeframe.

Exporting Tax Details

- Download the Data:

- Once you have selected the relevant date range, press the Download Excel button.

- This will generate an Excel file containing transaction details.

Reviewing Tax and Net Totals in Excel

- Locate the Relevant Columns:

- Open the downloaded Excel file.

- Look for the following key columns:

- Net Total: The base price of the transactions, excluding tax.

- Tax: The tax amount applied to each transaction.

These columns are essential for understanding your taxable amounts and total revenue.

EU Tax Considerations and the VIES System

- Understanding VIES:

- VIES (VAT Information Exchange System) is an EU database that allows businesses to check the VAT registration status of other businesses within the EU.

- It ensures that intra-EU business transactions are not subject to double taxation.

- If both the seller (you) and the buyer are VAT-registered and located in different EU member states, the sale can qualify as a zero-rated intra-community supply, exempt from VAT in the seller’s country.

- What You Need to Do and Oveit can be Set to Do for You:

- Verify your buyers’ VAT numbers using VIES.

- Record this verification to demonstrate compliance with VAT rules.

- If the buyer’s VAT number is valid, ensure the tax-exempt status is reflected in your transaction records. The “Tax” column for these transactions should show zero or indicate a VAT exemption.

Summary

By following these steps, you can efficiently extract and review tax details in Oveit. Use the Net Total and Tax columns for tax reporting and compliance. For EU businesses, understanding VIES and properly handling VAT exemptions will help avoid double taxation and streamline cross-border transactions.

If you need further clarification, feel free to reach out to our support team.

Disclaimer

The information provided in this article is for general informational purposes only and should not be considered as fiscal or tax advice. Event organizers are strongly encouraged to consult with a qualified tax or fiscal advisor to ensure compliance with applicable laws and regulations specific to their jurisdiction and circumstances. Oveit assumes no responsibility for the accuracy, completeness, or applicability of this information to individual cases.