Our goal at Oveit is to provide you with a robust event registration platform that simplifies the work and automates repetitive tasks. And invoicing can be considerably streamlined by automating it.

This article showcases the seamless process designed to keep event organizers focused on the essence of their roles, while our technology adeptly handles the complexities of compliance and invoicing after the eFactura regulations.

The Importance of Automated Invoicing for Event Organizers

For event organizers, automating the invoicing process is crucial for streamlining workflows. When your event participants place thousands of orders, manual invoicing is not an option.

Today, when efficiency and speed are essential for the success of any business, automating the invoicing process becomes crucial. It comes with many benefits, from saving time and reducing human errors to improving cash flow and improving the customer experience. In an environment where time is precious and financial management is vital, using event management solutions with an efficient invoicing automation system becomes an essential step for the growth of your business.

While taking take of the repetitive tasks, Oveit allows you to concentrate on what truly matters; delivering unforgettable experiences to your guests.

Oveit and Smartbill: An Efficient Solution for Event Organizers

Starting this year, eFactura is mandatory in Romania for all business-to-business invoicing. Understanding the significance of this regulation, we have worked to find the best way to automate this new process.

By integrating Oveit with Smartbill, we empower event organizers to enhance operational efficiency while staying in line with the latest legal requirements. This integration enables a seamless transition to the eFactura framework.

Through this integration, all invoices issued by Oveit for sold tickets are sent to a Smartbill account. From there, event organizers can upload them into the new system with a simple click of a button.

This integration provides an easy and quick solution to comply with the new eFactura regulations in Romania. However, different fiscal regulations apply to other regions as well. Although this article focuses on this specific integration, our APIs allow us to adapt to other similar scenarios as well.

Oveit X Smartbill: Step by Step Integration

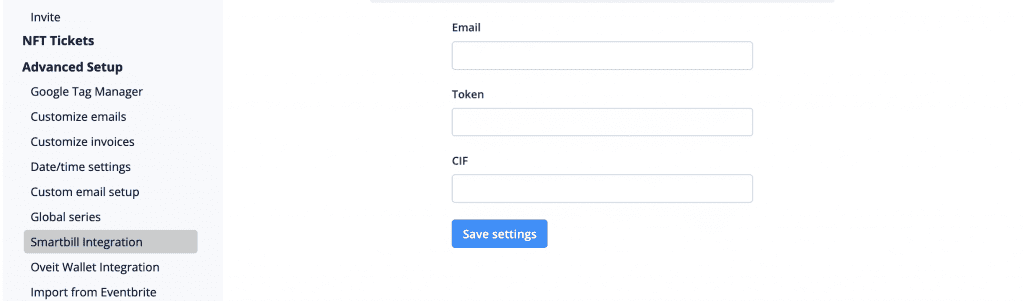

Once activated, the Smartbill integration will become active in your Dashboard. In the Advanced Setup menu, under Smartbill integration, you will find the required data you need to copy to Oveit.

Add your email address, token, and CIF from your Smartbill menu (found under Link/API settings in your Smartbill account).

Once you save your settings and the two accounts are interconnected, you need to set up a new invoice series on both platforms. Given that, both systems will use the same invoice series and numbering.

And that’s it! The integration is up and running!

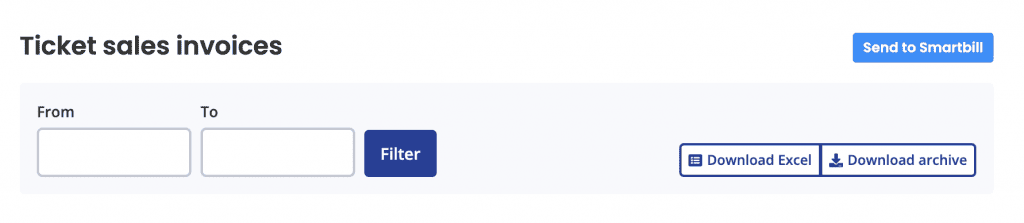

Now, under the Ticket sales invoices menu, you will see the Send to Smartbill button.

Send your ticket invoices to your Smartbill account. Keep all your invoices in one place. Moreover, using the eFactura option provided by Smartbill, upload all business-to-business invoices in the virtual space.

Comply with the new fiscal work frame with just a few clicks of a button. Use your spare time to focus on what makes you unique; the unforgettable experiences you deliver to your community.

Contact us if you want to discuss how to automate the repetitive tasks on your events.