The first version of what we now call Oveit Pay was launched in 2018. It was a system that allowed event planners to create a small event economy and monetize transactions done in their event space. Simply put they invited third-party vendors to their events. The vendors would sell goods (mostly food and beverage) and the event planner would get a cut of what was sold. This helped increase the event’s revenue.

The increase in revenue was and still is very important for many, many event planners, especially festival owners. Without this economic concept the festivals we enjoy were either not possible or very hard to pull off. After the Coronavirus outbreak and the reshuffling of the live entertainment business, closed loop payments model will probably become the norm for a lot of the festivals that will survive.

How Oveit Pay came to be

We were very rudimentary at first. The idea was to use an RFID tag to store monetary value for digital wallets, inside an event. People would wear wristbands which can be either topped up or used to spend existent value. In the beginning we tested everything on laptops and RFID readers. We purchased a bunch of RFID readers and would connect them to the laptops. We found out that different readers were reading different values on the wristbands, due to how they were designed. This was issue no. 1.

Another issue we found was that this concept was very unstable if we were to ship it outside of our area of support. We’ve had a client asking for the technology to be used in the city of Medellin, in Columbia. As Narcos was airing on Netflix we were jokingly discussing the implications and a need for remote deployment. So we needed to change the way we ship the product, from a hardware perspective. Laptops and RFID readers were not the way to go. This was issue no. 2.

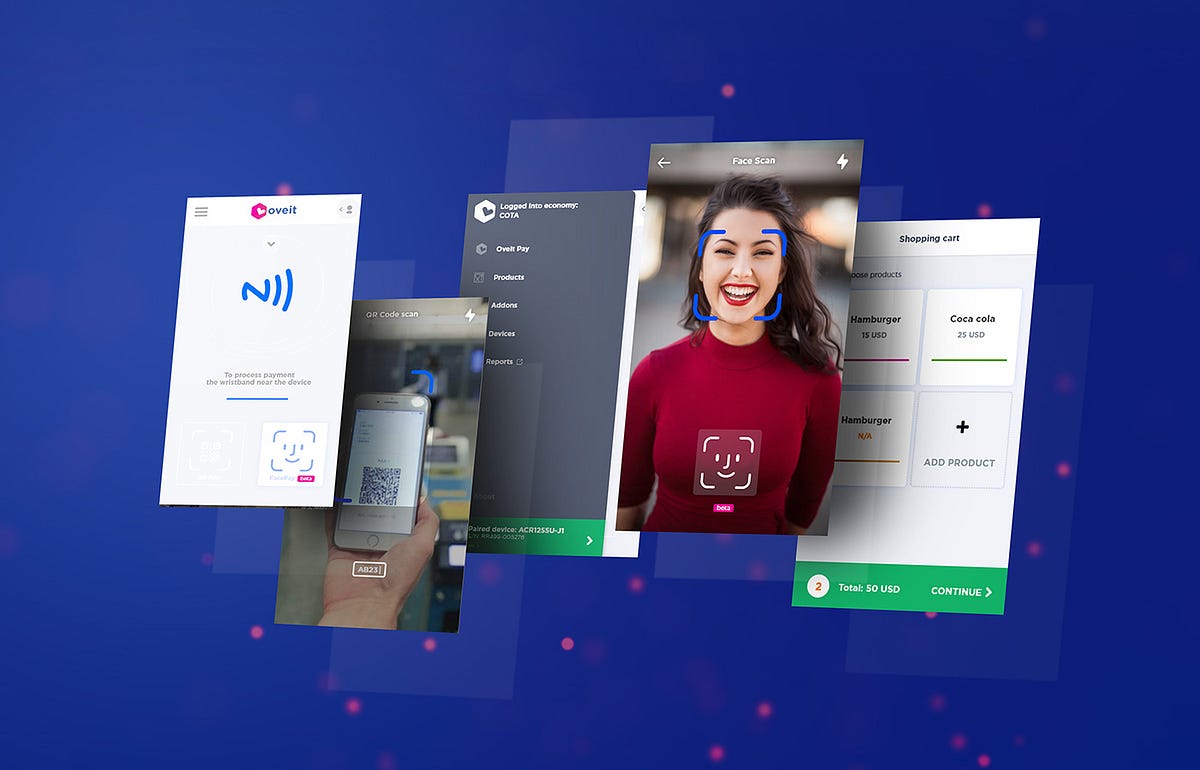

Issues 1 and 2 were both solved by switching our mindset from laptops to mobile devices (mostly Android smartphones). They were sturdy, easy to use and we could port our app to them. More importantly — they all had an NFC reading chip. What is an NFC chip? Glad you asked that. It’s a chip that reads some special kind of RFID tags that only work in proximity to the reader (NFC = Near Field Communication ).

When we thought we’d solved all of the issues a strange request came from an upcoming festival in the middle of a deserted island. The request was to run a closed loop payment network (checked) on a deserted island, on mobile devices (checked), without any internet connection (definitely not checked).

Making payments work offline

This was a tough one: our whole system was based on a cloud server processing sales and wallets, authentication and identities. There was no way that we were familiar with that could work in providing this closed loop without internet connectivity. So we started brainstorming.

At the time we witnessed protests against undemocratic changes to our country’s legislative structure. Protesters were organizing and communicating via mobile phones. When protests got bigger, radio communications were jammed. They had to resort to another way: using their Bluetooth connections to communicate via Firechat, a peer to peer messenger app. What Firechat did was turn each phone using it in a communication relay. Truth be told — it didn’t always work. But it showed us a direction we were going to head into.

We started working with 6 months left to deliver a product that would process payments on a deserted island, in the middle of the Danube river, where no Internet connection was stable. Did I mention the solution was going to be used by 5000 people?

We made it work with a distributed ledger approach that would move the data across mini-servers being run on sets of Raspberry Pi’s. We moved the data across an WiFi network in a secure way and basically created a mesh-network of servers and client devices that were running the apps on mobile phones.

The day of the festival came. We started late. Not only was there no internet but there was no stable electricity. It was raining. We had sand and dust everywhere. And I mean everywhere. One of the routers was fried due to unstable electricity and we had to drive 400 km to buy a replacement. Sony assisted in providing the mobile devices that were used as POS’s for vendors and top-up points.

Setting up the WiFi network was the hardest part. As electricity was unreliable, it was hard to test which part of the network was working or not. We basically created a network that beamed data from the riverwalk, where attendees would arrive and pretopup credit, to the island, covering a very, very large area, using just routers, access points, raspberry pi’s, mobile smartphones and our software.

It was fun and hard. Monitoring was unlike everything we’ve ever done. The music was running non-stop so there was always someone buying something. We were on constant alert.

It worked.

Not perfectly, but it worked. People were amazed how they couldn’t reach their Instagram profiles but they would just tap their wristband and a payment was made. To a certain degree — it was magic. The perfect blend of technology, a bohemian decor and something emerging right in front of our eyes: an economy and a sort of edge-society. Cut off from the world, the cloud, the big city life, people were enjoying a private festival, with all of the convenience of what we now see as our core pillar in the society we live in: the economy.

When I say economy, don’t think of it as something the government would set up and carefully curate. Don’t think of complicated formulas, central banks and banks in general. Think of it as the basic human behavior of exchanging goods and services. Think of our natural tendency to collaborate with one another and the logistics that emerge from it. Think of what money used to be before we start calling it money: a convention between groups that they will exchange the value of their work through a shared medium.

A new perspective on the world

It took us a while to understand what we were creating. In the back of our mind, the idea started to taking shape as soon as we saw the people on the island interacting with one another. But it took another two years to understand how we fit into the world and how we can make it better.

As the festival was ending I had to hop on a long-haul flight to Hangzhou, China. We were selected to present what we just tested on the island in an International Stars contest.

At the moment I was going through a bit of an issue in my medical condition that made it hard to travel long trips but I chose to go on the trip. First off — I was in charge of product development so I had to present what we did and how we did it. Second — I’ve never been there so I was curious about the country and how the society was evolving.

It was amazing. We discovered many things. One of them was that our technology was not about events. It was, as financial technology usually is, about society and the way that people interact with one another and share value. We’ve seen how WeChat and AliPay changed the Chinese society for the better and how a new wave of different payments technologies were coming. We decided to focus on the opportunity to improve the world with our tech. We just didn’t know how an events company can play a role in the big financial world.

It was at the beginning of 2019 that we received an investment and moved our HQ to Austin, Texas. In just three months we went from an event company that was doing event payments to a company that was doing a new type of payments — As David Smith suggested, we called the technology Edge Payments — payments at the edge of the cloud.

You see — most of the payments go through a global network of banks, payment processors, gateways, card acquirers and so on. Basically your data travels two times across the world before you buy the ice cream in front of you, if you use your credit card. With cash it’s different. Hand over the note and that’s it.

What if there was a way to process payments where they happened (what we actually did with our tech) and how could this change the world?

We went down that path and we discovered that what we did was offer our customers the benefits of running their own economy. At a small scale, restricted to several geographic virtual areas but an economy nevertheless.

They could onboard vendors and buyers, tokenize and incentivize behavior, add fungible and non-fungible payment tokens. At their fingertips was the potential to create and manage small scale economies. Economies at the edge of the cloud. While still connected to the outside world and money transfers still regulated by traditional means, their mini-economies could become flourishing islands of creative behavior.

Economy as a Service

What we understood was that our technology could impact more than events. It could, theoretically, impact the economy in a way that blogs, social media and tweets and videos have impacted the media companies. It created the power for communities to gather around common ideas, concepts and a new type of influencers.

We understood that Oveit Pay, the closed-loop payments app for festivals, could do more. It could empower communities: from a hotel resort to a neighborhood. From an island in the Atlantic to a city in the US Midwest that has its value extracted via global trade routes, leaving it lifeless and without a future. From Europe to the North Americas and from Japan to South Africa, we understood that we are all basically the same and so are our communities and their needs.

We understood that while the globalized world has great benefits, the strength of our society still sits with communities and these communities need to be empowered to create and retain wealth in their local ecosystems.

This is what we now call “Economy as a Service”. Whether it is online (in a game) or offline (in a city, a festival or a neighborhood) our Economy as a Service tool can connect and help its members form a community.

The mission of Oveit Pay

Our mission is to empower communities to empower themselves. In an increasingly complex world where everything is fast moving and global wealth is generated at the edges and collected at the center, something has to change.

Oveit Pay v2 gathers in one app what we have learned about the world in the past years. It is a tool for communities across a vast spectrum, from cities to virtual communities in games, that want to empower themselves. To do this, we think they are missing a key component. Their own economy. A way to retain the value they create and shape the way it is formed by its members.

It is a complicated mission and it may not be the best way to go. But if we want to improve the way we live today and have a hope at a better future we need to improve on two of the most important inventions of our species: our social structures and the concept of money and how it’s being moved around, with an emphasis on “moved”.

The world is struggling with economic inequity. The global issues following the Coronavirus outbreak will only add to the existing economic issues. We think we can play a part in providing a better future to all human communities, with a tool that helps when help is needed.

This is the mission of Oveit Pay — to bring economic power to communities. To help communities emerge, take shape and become stronger. Make their members’ lives a little better and help them live more fulfilled lives, doing what they love.

Mike Dragan

Oveit COO