Currently browsing: Uncategorized

Articles related to in-person and virtual events

The rise of touchless technology and its applications

In a world where social distancing is the new normal, touchless technologies begin to gain more and more interest. Before the global pandemic, people didn’t think twice before touching door handles, elevator buttons, or check-in kiosks. But as we speak, high touch surfaces are a hot topic as worries over health and safety are on the rise. As a result, fintech innovators and not only, are looking for ground-breaking alternatives to keep us all safe.

‘Work from home’ is certainly not a permanent alternative, since many businesses require employees to be physically present to get the job done. As you probably heard this before, Coronavirus is not likely to go away anytime soon, so touchless technologies seem like a great opportunity to get things back to normal. In response, some companies started to implement a touchless check-in process for visitors or even Bluetooth access control for employees.

It seems like it’s the perfect time to go touchless. Even if this need is forced by uncontrollable factors, such as a global pandemic, we should look on the bright side of it and become aware that going touchless is in our own good. So, let’s go over some examples of touchless technologies and find out more about it in general.

What are we trying to say by ‘going touchless’?

Well, despite how relevant this topic is as we speak, businesses going touchless is not new. In fact, touchless technology has been around since the late 1980s when motion-sensing faucets and soap dispensers were common within public restrooms. Today, we experience touchless technology several times a day. Just think of how many times you walk through an automated door or think of those moments when you ask Siri to turn on the timer for you.

As you can see, touchless technology is not limited to hygiene and safety. Societies look up to it and treat it as a forward-thinking and modern alternative to complete daily tasks. With that being said, we can define touchless technology as anything that can function without the need to physically touch a device.

Example of touchless technologies

- Gesture recognition

This is among the most common types of touchless technology. The way we interact with devices is simply replaced by gestures. For instance, waving your hand to activate an automated door replaces the need to physically touch its knob or button.

- Touchless sensing

Similar to gesture recognition, touchless sensing can detect the movement of an individual under a sensor. In our day to day lives, we come across this no-touch technology several times per day. Think of the last time that you went to a gas station, grocery store, or lodging facility. Most likely, there was no one to open the door for you and you didn’t have to do it yourself either. Thanks to touchless sensing, such actions are simplified and become part of our daily routine.

- Voice recognition

This form of touchless technology enables users to control a device by speaking to it. Android and Apple devices can be controlled by simply stating some keywords, such as ‘Hey Siri’, replacing the need to touch that device at all. Setting up reminders, timers or other tasks is as quick and simple as ever.

- Facial recognition

Not long ago, facial recognition seemed to be far from reality. Now, this touchless technology is available for millions of people, most often utilized to unlock smartphones. However, as more people gained interest in its capabilities, innovators found great use cases and environments where it can be applied. The KLM Royal Dutch Airlines started a test involving ‘biometric boarding’, allowing passengers to board the aircraft without showing their ID’s anymore, recognizing passengers by their faces.

- Personal devices

Apple Pay has proved that traditional credit cards can be left behind and that payments can be completed from our own devices. Compared to contactless payments, where users must touch the POS with a card to complete a transaction, personal devices provide a ‘cleaner’ alternative where that ‘touch’ is not necessary to successfully complete a transaction. Modern personal devices can store your credit/debit cards virtually. For safety reasons, upon completing a purchase, users can authenticate by using their own faces or by inputting a personal identification number.

Oveit as a touchless payment solution

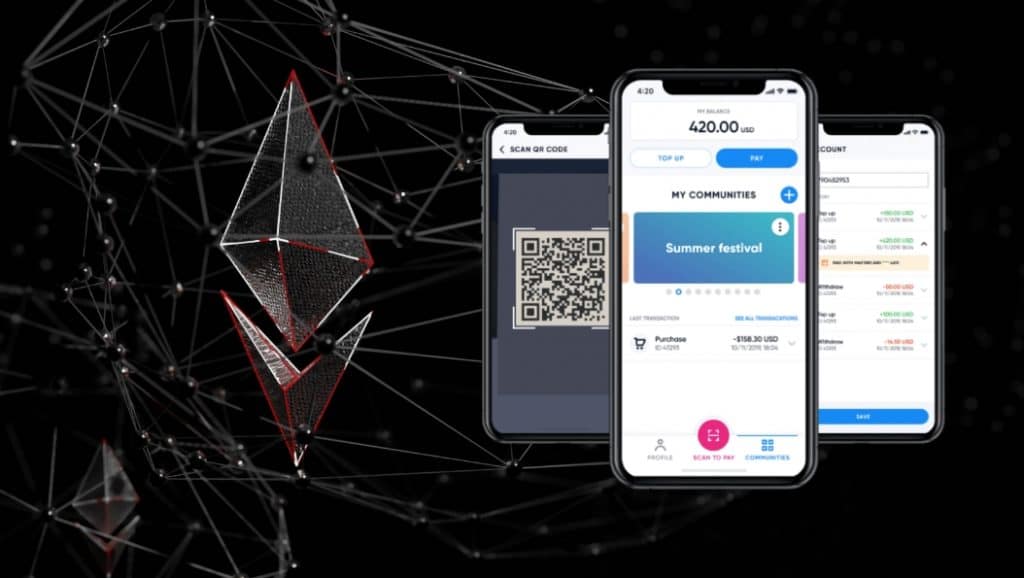

At Oveit, we strongly believe in the power of touchless technologies, especially during the current situation, that of a global pandemic. Until now, our Economy as a Service solution was partially touchless since economy members were required to visit an on-site top-up point to add money onto their digital wallets.

To tackle this challenge and identify ourselves as a complete touchless solution, we started to think the extra mile and concluded that an end-user App is what we need. The purpose of this App is to enhance the experience of our end-users, enabling them to top-up money in a defined economy, from the comfort of their own houses or wherever an internet connection is available.

For economy owners, this alternative should reduce costs, with fewer staff members required. Economy members simply become their own cashiers and upon arrival, their digital wallets should be ready to go. Also, if activated, the auto top-up feature allows users to set a warning limit. As soon as that warning limit is reached, the digital wallet automatically adds up the pre-defined amount from the linked credit/debit card.

Circular Economy: principles, benefits, and solutions

The main goal of a circular economy model is to produce goods and services in a sustainable manner by reducing the consumption and waste of resources (raw materials, water, energy). It contradicts with the traditional linear economy, that of a ‘take-make-consume-waste’.

According to many, a circular economy requires a local production capacity. It is a process that depends on fundamental changes to the existing production and consumption systems. According to the World Economic Forum, the world’s economy is only 9% circular. To become more efficient and preserve our natural resources, we must open our eyes and begin to think circular rather than linear.

Today, we are going to focus on the Circular Economy model, its principles, benefits, and existing solutions implemented to tackle the traditional linear economy.

The principles of the Circular Economy

In this model, every single product is manufactured and designed for future reuse, and ideally, at the end of its lifetime, it becomes a potential resource. Within this model, each stage in the economic cycle is modified, from producing goods and services to using them. It is an environment where products are built to last, with less energy and resources consumed. Please find below the three main principles of the Circular Economy.

1. Design out waste and pollution

What if waste and pollution were never created in the first place? In a circular model, product waste is eliminated straight from the design stage, meaning that goods can be used and reused longer, fixed more easily, and finally recycled to create additional industrial inputs.

2. Keep products and materials in use

A circular economy promotes activities where value in terms of energy, labor, and material is preserved. With the available technologies and innovative solutions, products should be designed for durability, reuse, remanufacturing, and recycling. This leads to a closed-loop production system, where components are circulating the economy. It takes advantage of bio-based materials, allowing businesses to reuse them for several products.

3. Regenerate natural systems

The process of extracting and processing natural resources causes 90% of global biodiversity loss and water stress while harming the global climate. The World Economic Forum predicts that by 2060, the current resource use of 190 billion tones will double and exceed our planetary boundaries. Therefore, changes in business and policy models must occur.

A circular economy is designed to eliminate the use of non-renewable resources, preserving, and focusing on renewable ones. This way, valuable nutrients are returned to the soil and renewable energy is used rather than fossil fuels.

Economic benefits of a Circular Economy

At a macro level, circularity has many economic advantages. A surplus of $2 trillion a year could result from more effective resource management. This is due to a substantial decrease in the cost of raw materials.

- Considerable resource savings

Even if more and more people become aware of the circular economy model, the extraction and prices of the main raw materials are still on the rise. In 2019, only 9% of all raw materials were recycled. In theory, a circular economy should recycle 100% of these materials, without new virgin raw materials required. However, it is predicted that this scenario will take quite a long time to be accomplished. Innovative methods should be applied to completely recycle materials that are utilized in production.

- Economic growth

In this model, economic growth is not dependent on the scarcity of raw materials. It is predicted that a shift towards the circular economy is set to promote economic growth. Since new raw materials are not extracted anymore, the development, maintenance, and production of circular products will require a specialized workforce, increasing the number of jobs. With less demand for specialized jobs in the extraction and processing of raw materials, specialized employees will have to adjust to a new work environment.

- Employment opportunities

As previously mentioned, the need to extract raw materials is not fundamental within a circular model. For this reason, such an economy requires a specialized workforce with a new set of relevant skills and aptitudes. Therefore, workers that extract and process raw materials might have to adapt and get familiar with new procedures and environments. The existing studies anticipate a modest, but positive impact of Circular Economy on employment volume.

- A good reason to innovate

Change comes with a desire to innovate. Thinking circular rather than linear already motivates innovators to optimize the entire system. This will form new collaborations between different parties involved, such as recyclers, producers, and designers. They can add more knowledge and great value in terms of sustainable innovations.

Circular Economy solutions

- CleanCup

Headquartered in Lyon, France, CleanCup is a solution designed to eliminate the use of disposable cups. They promote it as a turnkey solution meant to distribute, collect, and automatically wash reusable cups. Places such as campuses, companies, and communities are prioritized since those tend to generate a lot of waste.

Globally, it was established that people use 500 billion plastic cups and 16 billion coffee cups coated in paper. In theory, it is possible to recycle disposable cups, but the manufacturing process tends to be somewhat difficult, leading to very few of them being recycled. With CleanCup, one can get a clean and empty cup for a 1€ deposit. At any point in time, the user simply puts the cup back inside the machine and gets back the deposit. As soon as a cup is returned, the machine automatically washes it to be reused.

- Positive Energy Ltd.

This is a matchmaking platform between investors and small to mid-scale renewable energy facilities. Its purpose is to allow investors to easily find projects that require renewable energy financing. This blockchain-based asset financing, trading, and management platform digitalize the transaction workflow, making renewable energy investments fast, liquid, and transparent for all parties involved.

This initiative aims to boost renewable energy investments. By 2030, it could save around 20 million tons of CO2 per year. It is widely accessible and profitable for shareholders, with return on investment.

- RePack

This solution replaces the single-use delivery packages in e-commerce, providing reusable, and returnable delivery packaging. It is cost-efficient and environmentally friendly, with 78% less CO2 created and 92% less landfill waste, compared to traditional packaging.

Users can simply return these packages in letter-size or to any location using RePack packaging. Customers are incentivized to return used boxes through different vouchers to be redeemed at any participating RePack store. This packaging can be used at least 20 times.

Oveit as a possible solution to track local recycling practices

Not long ago, we concluded that our technology can be utilized in different contexts. Among these, we feel that Oveit can be looked at as a viable solution to track and incentivize communities to recycle responsibly.

By using NFC wristbands or cards, community members can be rewarded and incentivized to recycle waste. It could add up gamification elements to an important cause. Participating locations can simply use any Android NFC enabled device to scan cards or wristbands. Based on the expected outcome, members can easily be rewarded in real-time. For instance, the economy owner might reward members that recycle at least three times per week. To record data, NFC readers could be placed nearby waste containers. Members that recycle enough are automatically rewarded and all that information is stored on their digital accounts (NFC wristband or card).

Cash to Cards to Contactless: A Historic Tale of Event Payments

In the world of conferences, conventions, and business events, the way attendees register and make payments has significantly evolved over the years. From traditional cash transactions at the event venue to today’s seamless online payments, the evolution of payment methods has enhanced convenience, security, and overall attendee experience. Let’s explore the four key stages of this evolution.

Cash Payments at the Venue:

In the early days of events, attendees would register on-site, often waiting in long queues, and pay for their registrations with cash. This method was not only time-consuming but also prone to errors and security issues. Event organizers had to deal with the challenges of handling large amounts of cash, and attendees had to carry significant amounts of money with them.

Credit Card Payments and Online Registrations:

The introduction of credit card payments brought a significant shift in the event registration process. Attendees could now pre-register for events online, providing their credit card information for a secure payment process. This method reduced on-site registration queues and allowed organizers to plan better for the event. Online registration platforms emerged, enabling attendees to sign up from the comfort of their homes or offices, streamlining the entire process.

Mobile Payment Solutions:

As smartphones became ubiquitous, event organizers started exploring mobile payment solutions. These solutions enabled attendees to make payments through their mobile devices, either via credit cards or mobile wallets. Attendees no longer needed to carry physical cards or cash, and transactions became faster and more convenient. Mobile payment technologies also enhanced security by incorporating encryption and authentication measures.

Contactless Payments and Digital Tickets:

In recent years, the rise of contactless payment technologies has revolutionized event registrations. Attendees can now use their smartphones or contactless cards to make payments by simply tapping or scanning at the point of entry. This method not only ensures a swift and hygienic transaction process but also reduces the need for physical tickets. Digital ticketing systems have become more prevalent, allowing attendees to access event details, schedules, and updates through their smartphones. New advances in the field of cyber security has enabled the creation of what are called Smart Tickets, a new form of access control that combines digital ticketing with payment processing. These tickets are based on a blockchain technology called NFT that enable secure identification, decrease fraud and help fight scalping.

The evolution of payments for registrations at events, from cash transactions to contactless payments, has transformed the attendee experience significantly. As technology continues to advance, we can expect further innovations in the event registration process, such as biometric payments and blockchain-based ticketing. By embracing these advancements, event organizers can continue to enhance convenience, security, and efficiency, ultimately creating more rewarding experiences for attendees at conferences, conventions, and business events.

Oveit, as an end-to-end event registration solution, offers a comprehensive set of features that revolutionize the way events accept payments, manage visitor data, print networking badges, and optimize customer outreach policies. Let’s explore how Oveit facilitates each of these aspects:

Instant Payment Processing:

With Oveit, events can accept payments instantly through various channels, including online payment gateways, bank transfer, mobile wallets, and contactless payments. Attendees can register and make payments in real-time, eliminating the need for on-site cash transactions or manual credit card processing. This streamlined payment process reduces queues and enhances the overall attendee experience, making it convenient and efficient for both event organizers and visitors.

Real-Time Visitor Data:

Oveit provides event organizers with real-time access to visitor data. As attendees register and make payments, their information is immediately available on the platform. This data includes attendee demographics, ticket type, preferences, and more. Having real-time access to such insights enables event organizers to make informed decisions on the spot, adjust marketing strategies, and understand attendee preferences, which can contribute to better event planning and success.

On-Arrival Networking Badge Printing:

Oveit simplifies the check-in process by offering on-arrival networking badge printing. Attendees can receive personalized badges with their names and relevant information as soon as they arrive at the event venue. This not only saves time but also fosters a sense of professionalism and personalized engagement, helping attendees connect more easily during networking sessions. Organizers can customize badge templates and even incorporate QR codes for additional functionalities, such as lead retrieval and session tracking.

Optimized Customer Outreach Policy:

By utilizing real-time visitor data and analytics provided by Oveit, event organizers can optimize their customer outreach policies. They can tailor marketing campaigns based on attendee preferences, behavior, and feedback. Oveit’s data insights help identify target audiences, understand their interests, and tailor communication to engage attendees effectively. This targeted approach can lead to higher attendee satisfaction, increased event loyalty, and a more successful event overall.

Oveit’s end-to-end event registration solution empowers events to streamline payment processing, access real-time visitor data, facilitate on-arrival badge printing, and optimize customer outreach policies. By embracing Oveit’s innovative features, event organizers can enhance the overall event experience, build stronger connections with attendees, and ensure the success of their conferences, conventions, and business events. With a focus on efficiency, personalization, and data-driven decision-making, Oveit enables events to evolve and adapt to the changing landscape of event management in the digital age.