In a world where social distancing is the new normal, touchless technologies begin to gain more and more interest. Before the global pandemic, people didn’t think twice before touching door handles, elevator buttons, or check-in kiosks. But as we speak, high touch surfaces are a hot topic as worries over health and safety are on the rise. As a result, fintech innovators and not only, are looking for ground-breaking alternatives to keep us all safe.

‘Work from home’ is certainly not a permanent alternative, since many businesses require employees to be physically present to get the job done. As you probably heard this before, Coronavirus is not likely to go away anytime soon, so touchless technologies seem like a great opportunity to get things back to normal. In response, some companies started to implement a touchless check-in process for visitors or even Bluetooth access control for employees.

It seems like it’s the perfect time to go touchless. Even if this need is forced by uncontrollable factors, such as a global pandemic, we should look on the bright side of it and become aware that going touchless is in our own good. So, let’s go over some examples of touchless technologies and find out more about it in general.

What are we trying to say by ‘going touchless’?

Well, despite how relevant this topic is as we speak, businesses going touchless is not new. In fact, touchless technology has been around since the late 1980s when motion-sensing faucets and soap dispensers were common within public restrooms. Today, we experience touchless technology several times a day. Just think of how many times you walk through an automated door or think of those moments when you ask Siri to turn on the timer for you.

As you can see, touchless technology is not limited to hygiene and safety. Societies look up to it and treat it as a forward-thinking and modern alternative to complete daily tasks. With that being said, we can define touchless technology as anything that can function without the need to physically touch a device.

Example of touchless technologies

- Gesture recognition

This is among the most common types of touchless technology. The way we interact with devices is simply replaced by gestures. For instance, waving your hand to activate an automated door replaces the need to physically touch its knob or button.

- Touchless sensing

Similar to gesture recognition, touchless sensing can detect the movement of an individual under a sensor. In our day to day lives, we come across this no-touch technology several times per day. Think of the last time that you went to a gas station, grocery store, or lodging facility. Most likely, there was no one to open the door for you and you didn’t have to do it yourself either. Thanks to touchless sensing, such actions are simplified and become part of our daily routine.

- Voice recognition

This form of touchless technology enables users to control a device by speaking to it. Android and Apple devices can be controlled by simply stating some keywords, such as ‘Hey Siri’, replacing the need to touch that device at all. Setting up reminders, timers or other tasks is as quick and simple as ever.

- Facial recognition

Not long ago, facial recognition seemed to be far from reality. Now, this touchless technology is available for millions of people, most often utilized to unlock smartphones. However, as more people gained interest in its capabilities, innovators found great use cases and environments where it can be applied. The KLM Royal Dutch Airlines started a test involving ‘biometric boarding’, allowing passengers to board the aircraft without showing their ID’s anymore, recognizing passengers by their faces.

- Personal devices

Apple Pay has proved that traditional credit cards can be left behind and that payments can be completed from our own devices. Compared to contactless payments, where users must touch the POS with a card to complete a transaction, personal devices provide a ‘cleaner’ alternative where that ‘touch’ is not necessary to successfully complete a transaction. Modern personal devices can store your credit/debit cards virtually. For safety reasons, upon completing a purchase, users can authenticate by using their own faces or by inputting a personal identification number.

Oveit as a touchless payment solution

At Oveit, we strongly believe in the power of touchless technologies, especially during the current situation, that of a global pandemic. Until now, our Economy as a Service solution was partially touchless since economy members were required to visit an on-site top-up point to add money onto their digital wallets.

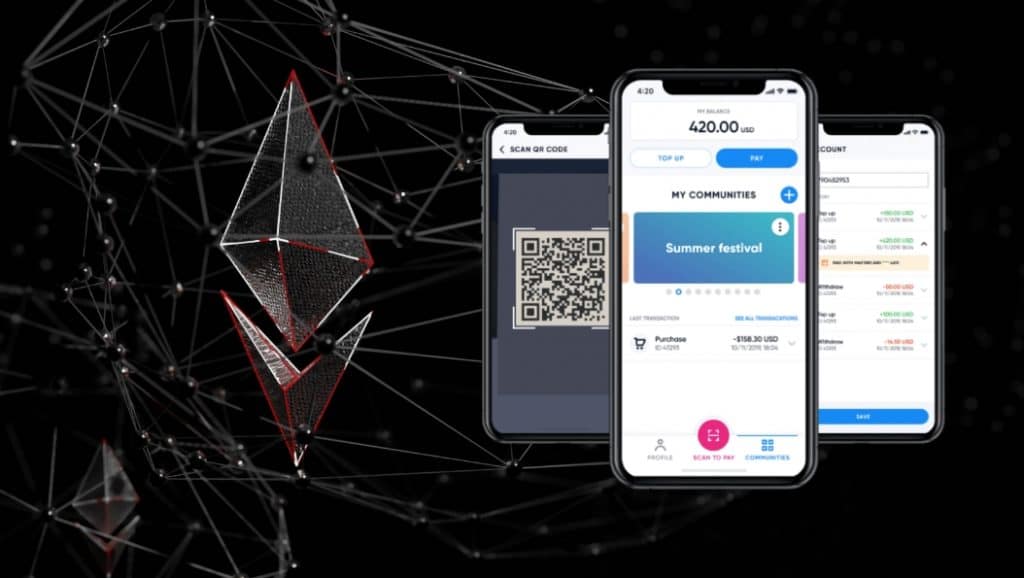

To tackle this challenge and identify ourselves as a complete touchless solution, we started to think the extra mile and concluded that an end-user App is what we need. The purpose of this App is to enhance the experience of our end-users, enabling them to top-up money in a defined economy, from the comfort of their own houses or wherever an internet connection is available.

For economy owners, this alternative should reduce costs, with fewer staff members required. Economy members simply become their own cashiers and upon arrival, their digital wallets should be ready to go. Also, if activated, the auto top-up feature allows users to set a warning limit. As soon as that warning limit is reached, the digital wallet automatically adds up the pre-defined amount from the linked credit/debit card.